Look for coverage for medical expenses, trip cancellations, and lost belongings. Verify the policy’s exclusions and claim process.

Travel insurance provides essential protection against unforeseen events that can disrupt your trip. It covers medical emergencies, trip cancellations, and lost or damaged items, ensuring you are not left out of pocket. Understanding what your policy includes and excludes is crucial to avoid any surprises.

Checking the claim process and customer reviews can also help you choose the right insurer. With the right travel insurance, you can enjoy peace of mind, knowing you are protected against potential risks while traveling. This guide helps you understand the key aspects to consider when selecting travel insurance.

Credit: www.careinsurance.com

Table of Contents

Introduction To Travel Insurance

Planning a trip is exciting but comes with risks. Travel insurance can save you from unexpected problems. This blog post will guide you on what to look for when getting travel insurance.

Travel insurance is a safety net for travelers. It covers unexpected events like medical emergencies, trip cancellations, and lost luggage. Without it, you could face high costs and stress during your trip.

The Importance Of Travel Insurance

Travel insurance is crucial for several reasons:

- Medical Emergencies: Covers hospital stays and doctor visits abroad.

- Trip Cancellations: Reimburses you if you have to cancel your trip.

- Lost Luggage: Compensates for lost or stolen belongings.

- Travel Delays: Provides coverage for unexpected delays.

Common Misconceptions About Travel Coverage

Many travelers have misconceptions about travel insurance:

| Misconception | Reality |

|---|---|

| It’s too expensive. | Travel insurance is affordable and can save you money. |

| My credit card covers everything. | Credit cards often provide limited coverage. |

| I’m healthy; I don’t need it. | Anyone can face unexpected emergencies while traveling. |

Medical Emergencies And Health Coverage

Medical emergencies can happen anytime during your travels. Having travel insurance with comprehensive health coverage is essential. It ensures you get the care you need without a financial burden. Let’s explore the key aspects of medical coverage in travel insurance.

Hospital And Doctors’ Fees

One of the most important factors is coverage for hospital and doctors’ fees. Look for policies that cover:

- Hospital stays

- Emergency room visits

- Doctors’ consultations

- Diagnostic tests

- Prescription medications

These expenses can add up quickly. Ensure your policy covers these costs to avoid high out-of-pocket expenses.

Evacuation And Repatriation

In severe cases, you might need evacuation to a medical facility or repatriation to your home country. Check if your travel insurance includes:

- Medical evacuation to the nearest suitable hospital

- Costs of transporting you back home

- Companion travel expenses

These services can be lifesaving and prevent financial strain on your family.

Pre-existing Conditions And Their Coverage

Many travelers have pre-existing medical conditions. It’s crucial to understand how your policy handles them. Look for:

| Policy Feature | Details |

|---|---|

| Pre-existing Condition Coverage | Some policies cover pre-existing conditions if declared in advance. |

| Waiting Periods | Check if there are any waiting periods before coverage starts. |

| Exclusions | Understand what conditions or treatments are excluded. |

Being aware of these details ensures you aren’t caught off guard by unexpected medical costs.

Trip Cancellation Policies

Trip cancellation policies are a critical part of travel insurance. They protect your investment if unexpected events prevent you from traveling. Knowing what to look for can save you time and money.

Reimbursement For Nonrefundable Reservations

Travel plans can change unexpectedly. Ensure your travel insurance includes reimbursement for nonrefundable reservations. This covers prepaid expenses like flights, hotels, and tours.

Here’s a simple table summarizing typical reimbursable items:

| Item | Details |

|---|---|

| Flights | Nonrefundable tickets |

| Hotels | Prepaid accommodations |

| Tours | Booked excursions |

“cancel For Any Reason” Benefits

A “Cancel for Any Reason” (CFAR) benefit offers maximum flexibility. It allows you to cancel your trip for any reason and still get some reimbursement. This benefit usually covers 50% to 75% of your trip costs.

Keep in mind:

- CFAR must be purchased within a specific time frame.

- Cancellation must occur at least 48 hours before departure.

Understanding The Fine Print

Always read the fine print. Policies can have exclusions that might surprise you. For example, some policies don’t cover cancellations due to pre-existing conditions.

Here are tips to help you understand the policy better:

- Check the exclusions list.

- Understand the claim process.

- Know the time limits for filing a claim.

Coverage For Delays And Disruptions

Travel can be unpredictable. Flights get delayed, connections get missed, and plans change. That’s where travel insurance comes in. It offers coverage for various delays and disruptions. This section will help you understand what to look for in your travel insurance.

Travel Delays And Accommodation Coverage

Travel delays are common. Ensure your travel insurance covers delays. Look for policies that offer compensation for meals and accommodation. This is crucial if your flight is delayed overnight. Check if your policy has a minimum delay time before it kicks in. Some policies cover delays of three hours or more.

| Delay Duration | Covered Expenses |

|---|---|

| 3+ hours | Meals |

| 6+ hours | Accommodation |

| 12+ hours | Additional Travel Costs |

Missed Connections And Their Impact

Missed connections can ruin a trip. Travel insurance can help. Look for policies that cover missed connections. This includes compensation for rebooking fees. Some policies may also cover accommodation if an overnight stay is required. Always check the policy details to know what’s covered.

- Rebooking Fees

- Accommodation Costs

- Meals and Transport

How To Handle Trip Interruptions

Trip interruptions can happen. This includes unexpected events like illness or natural disasters. Make sure your travel insurance covers trip interruptions. Look for policies that offer trip interruption protection. This should include reimbursement for unused portions of your trip. Also, check if it covers additional travel expenses to return home.

- Check Reimbursement Options

- Look for Coverage on Additional Travel

- Ensure Policy Covers Unused Portions of Trip

Personal Liability And Accidents

When traveling, unexpected incidents can occur. Personal liability and accidents coverage in travel insurance can protect you. This coverage ensures you are not financially burdened by unforeseen events.

Coverage For Personal Injury

Travel insurance should cover personal injuries. This includes medical expenses if you get hurt. It also covers hospital stays and doctor fees. Always check the maximum coverage limit.

Damage Caused By Policyholders

Sometimes, travelers may accidentally damage property. Travel insurance should cover damage caused by policyholders. This includes hotel property, rental cars, and other assets. It’s essential to know the liability limits.

Legal Assistance While Abroad

Legal issues can arise during trips. Legal assistance while abroad is crucial. This coverage helps with legal fees and court costs. It also provides access to legal advice.

| Coverage Type | Description |

|---|---|

| Personal Injury | Medical expenses, hospital stays, and doctor fees |

| Damage Caused | Liability for property damage |

| Legal Assistance | Legal fees, court costs, and advice |

- Always check the maximum coverage limit.

- Know the liability limits for property damage.

- Ensure access to legal advice is included.

Lost, Stolen, Or Damaged Possessions

Traveling is fun, but it comes with risks. One major concern is lost, stolen, or damaged possessions. Travel insurance can help cover these incidents. Knowing what to look for is crucial to ensure you are adequately protected.

Claims For Baggage And Personal Items

Most travel insurance plans cover baggage and personal items. If your luggage gets lost or damaged, you can file a claim. Make sure your policy includes this coverage.

Keep receipts of your items to support your claim. Documenting your belongings before the trip is also helpful. This ensures smoother processing and increases the likelihood of approval.

Temporary Replacement Items

Some policies offer coverage for temporary replacement items. This is useful if your luggage is delayed. You can buy essentials like clothes and toiletries. Check if this is included in your policy.

| Item | Maximum Coverage |

|---|---|

| Clothing | $200 |

| Toiletries | $100 |

| Electronics | $300 |

Limits And Exclusions For Valuables

Travel insurance usually has limits and exclusions for valuables. Items like jewelry and electronics may have specific caps. For example, your policy might cover up to $500 for a laptop.

Some items may not be covered at all. Always read the fine print. Knowing these details helps you plan better and avoid surprises.

Here are some common exclusions:

- Antiques

- Collector’s items

- High-value electronics

Adventure And Special Activities Coverage

Planning for an adventure trip? Travel insurance can be your best friend. It offers protection during high-adventure tourism, sports, and recreational activities. This coverage ensures peace of mind. Your special equipment and gear are also protected. Let’s dive into the specifics.

Risks Of High-adventure Tourism

High-adventure tourism includes activities like skydiving, bungee jumping, and rock climbing. These activities are thrilling but risky. Injuries can happen. Medical expenses can be high. Travel insurance for high-adventure tourism covers medical emergencies. It also covers rescue operations and evacuation.

Key points to consider:

- Check if your policy covers high-risk activities.

- Ensure coverage for medical evacuation.

- Look for policies with high medical expense limits.

Sports And Recreational Activities

Sports and recreational activities are fun. Activities like skiing, scuba diving, and surfing need special coverage. Regular travel insurance might not cover these. Look for a policy that includes sports and recreational activities. This ensures you are protected during your trip.

Important coverage aspects:

- Accidental injuries during sports activities.

- Emergency medical treatments.

- Damage to rented sports equipment.

Special Equipment And Gear Insurance

Special equipment and gear can be expensive. Travel insurance can cover lost, stolen, or damaged gear. This is crucial for activities like photography, skiing, and diving. Ensure your policy includes special equipment and gear insurance.

Coverage details to check:

| Equipment Type | Coverage Limit | Conditions |

|---|---|---|

| Photography Gear | $2,000 | Proof of purchase required |

| Ski Equipment | $1,500 | Rental insurance included |

| Diving Gear | $1,000 | Must be used with licensed instructor |

Always read the fine print. Make sure your special gear is covered adequately. This ensures a worry-free adventure.

Understanding Policy Exclusions

When purchasing travel insurance, understanding policy exclusions is crucial. These exclusions can determine what is not covered by your insurance. This can significantly affect your claims. Knowing these details helps avoid surprises during emergencies.

Events Not Covered

Most travel insurance policies have a list of events they do not cover. These can include:

- Pre-existing medical conditions

- Extreme sports and activities

- Traveling against medical advice

- Losses due to war or terrorism

- Natural disasters

It is essential to read the fine print. Understand which events fall under exclusions. This helps in making informed decisions.

Government-imposed Travel Restrictions

Travel insurance often does not cover trips affected by government-imposed travel restrictions. This includes:

- Travel bans

- Quarantine requirements

- Lockdowns and curfews

Check the latest government advisories. Ensure your destination is not under any restrictions. This can save you from potential claim denials.

How To Navigate Policy Exclusions

To navigate policy exclusions effectively, consider the following steps:

- Read the entire policy document. Familiarize yourself with all terms and conditions.

- Ask questions. Contact the insurance provider for any unclear points.

- Compare multiple policies. Look for the one with the least exclusions.

- Consider add-ons. Some policies offer additional coverage for specific exclusions.

Understanding policy exclusions is vital. It helps in selecting the right travel insurance. Always stay informed and choose wisely.

Choosing The Right Policy

Travel insurance is a must for any trip. The right policy can save you from unexpected costs and hassles. Here’s a detailed guide on what to look for when choosing the perfect travel insurance policy.

Assessing Your Travel Insurance Needs

Start by assessing your needs. Consider the type of trip you are taking. Are you going for leisure or business? Are there any planned activities that might be risky, like skiing or scuba diving? These factors will help you determine the level of coverage you need.

- Medical coverage: Ensure it covers medical emergencies.

- Trip cancellation: Protects you if your trip gets canceled.

- Lost luggage: Covers the cost of lost or stolen items.

Evaluate your destination. Some countries have higher medical costs. You might need more coverage if traveling to such locations.

Comparing Different Insurance Providers

Research various insurance providers. Compare their policies and prices. Look for providers with good reputations and customer service.

| Provider | Coverage | Price | Customer Reviews |

|---|---|---|---|

| Provider A | Comprehensive | $$$ | 4.5/5 |

| Provider B | Basic | $$ | 4.0/5 |

| Provider C | Extensive | $$$$ | 4.8/5 |

Reading Reviews And Fine Print

Always read reviews. Check what other travelers say about the insurance provider. Look for common complaints and praises.

- Read customer reviews on trusted sites.

- Check social media for real-time feedback.

- Ask friends or family for recommendations.

Don’t skip the fine print. Understand the terms and conditions. Look for exclusions and limitations. Some policies might not cover pre-existing conditions. Others might exclude risky activities.

Ensure the policy covers all your needs. This will help you avoid surprises during your trip.

Credit: www.forbes.com

Purchasing Your Policy

Buying travel insurance can seem overwhelming. But it’s essential for a safe trip. Here’s what to keep in mind when purchasing your policy.

Best Time To Buy Travel Insurance

The best time to buy travel insurance is right after booking your trip. This ensures you get coverage for unexpected events that may occur before your departure. Early purchase can also provide protection for pre-existing conditions.

Where To Purchase Your Policy

There are several places to purchase your travel insurance policy:

- Insurance Companies: They offer comprehensive plans directly.

- Travel Agencies: Convenient but may be more expensive.

- Online Comparison Sites: Useful for comparing different policies.

- Credit Card Providers: Some offer travel insurance as a perk.

Documentation And Proof Of Insurance

Having proper documentation is crucial. Ensure you have the following:

- Policy Document: Shows coverage details and terms.

- Emergency Contacts: For immediate assistance during your trip.

- Proof of Purchase: Validates your insurance coverage.

Keep digital and physical copies of these documents. This ensures easy access in case of an emergency.

Making A Claim

Understanding how to file a claim is essential when you have travel insurance. Knowing the steps and requirements ensures a smooth and stress-free process. Let’s break down the key aspects of making a claim.

Step-by-step Guide To Filing A Claim

- Notify the Insurance Provider: Contact your insurance provider as soon as an incident happens.

- Fill Out Claim Forms: Obtain and complete the necessary claim forms from your provider.

- Gather Required Documentation: Collect all relevant documents to support your claim.

- Submit the Claim: Send your completed forms and documents to the insurance provider.

- Follow Up: Keep track of your claim status and follow up if necessary.

Documentation And Evidence For Claims

Proper documentation is crucial for a successful claim. Here are some documents you may need:

- Medical Reports: For medical claims, provide hospital records and doctor’s notes.

- Receipts and Invoices: Submit original receipts for expenses incurred during your trip.

- Police Reports: For theft or loss, obtain a police report from the local authorities.

- Travel Itinerary: Include your travel itinerary to verify your travel details.

- Proof of Payment: Provide proof of payment for bookings and reservations.

Timelines And Processing

Understanding timelines and processing times helps manage your expectations:

| Claim Type | Processing Time |

|---|---|

| Medical Claims | 2-4 weeks |

| Trip Cancellation | 4-6 weeks |

| Lost Baggage | 1-2 weeks |

Make sure to submit your claim within the specified time frame mentioned in your policy. Late submissions can lead to delays or rejections.

Final Thoughts

Choosing the right travel insurance can make or break your trip. It’s crucial to know what to look for when evaluating different policies. Here are some final points to consider.

Weighing The Cost Against The Benefits

Travel insurance policies vary widely in cost and coverage. Ensure you balance the premium with the benefits offered. A higher premium might be worth it for extensive medical coverage or trip cancellation protection.

| Coverage Type | Benefits |

|---|---|

| Medical Expenses | Covers hospital stays and doctor visits |

| Trip Cancellation | Reimbursement for non-refundable trip costs |

| Lost Luggage | Compensation for lost or damaged items |

Personal Stories And Experiences

Many travelers share their experiences with travel insurance. These stories can offer valuable insights. For example, Jane’s story of losing her luggage in Europe highlights the importance of baggage coverage.

Another traveler, Mike, had a medical emergency in Asia. His insurance covered the hospital bills, saving him thousands of dollars. Real-life experiences can guide you in making an informed decision.

Tips For Traveling With Peace Of Mind

- Read the fine print: Understand what is and isn’t covered.

- Compare multiple policies: Use comparison tools to find the best fit.

- Know your needs: Tailor your coverage to your specific travel plans.

These tips can ensure that you travel with confidence and peace of mind. Knowing that you are protected can make your trip more enjoyable.

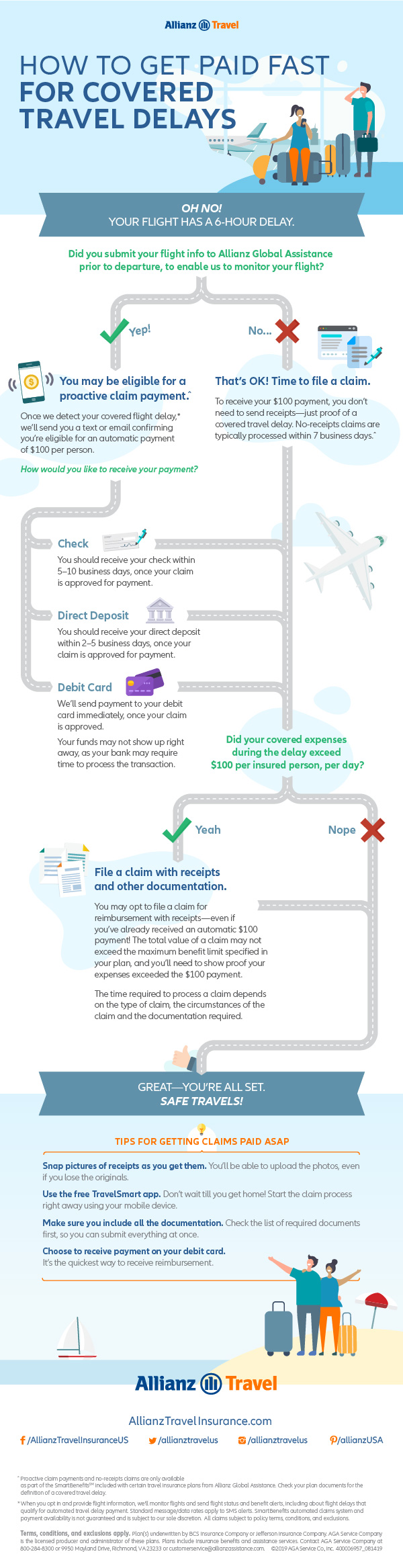

Credit: www.allianztravelinsurance.com

Frequently Asked Questions

What Should Be Included In Travel Insurance?

Travel insurance should include medical coverage, trip cancellation, lost luggage, emergency evacuation, and personal liability protection.

What Is The Most Common Travel Insurance Claim?

The most common travel insurance claim is for medical emergencies. This includes sudden illnesses or injuries during a trip.

What Kind Of Travel Insurance Do I Need?

You need travel insurance that covers medical emergencies, trip cancellations, lost luggage, and personal liability.

What Is Not Covered By Travel Insurance?

Travel insurance typically doesn’t cover pre-existing conditions, known events, government restrictions, acts of war, or epidemics.

What Does Travel Insurance Cover?

Travel insurance typically covers medical expenses, trip cancellations, lost belongings, and personal liability.

Conclusion

Choosing the right travel insurance is crucial for a worry-free trip. Ensure it covers medical emergencies, trip cancellations, and lost belongings. Compare policies, read reviews, and understand the terms. A well-selected travel insurance plan offers peace of mind, protecting you from unexpected expenses.

Safe travels!